Page 106 - 2596-CA SR Lanka- Annual Report 2022

P. 106

NOTES TO THE FINANCIAL STATEMENTS

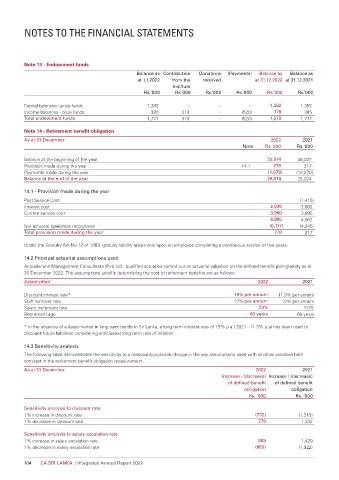

Note 13 - Endowment funds

Balance as Contribution Donations (Payments) Balance as Balance as

at 1.1.2022 from the received at 31.12.2022 at 31.12.2021

Institute

Rs.'000 Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000

Capital balances - prize funds 1,392 - - - 1,392 1,392

Income balances - prize funds 385 313 - (520) 178 385

Total endowment funds 1,777 313 - (520) 1,570 1,777

Note 14 - Retirement benefit obligation

As at 31 December 2022 2021

Note Rs.'000 Rs.'000

Balance at the beginning of the year 25,974 36,027

Provision made during the year 14.1 778 217

Payments made during the year (1,678) (10,270)

Balance at the end of the year 25,074 25,974

14.1 - Provision made during the year

Past Service Cost - (1,415)

Interest cost 2,935 2,882

Current service cost 3,960 3,095

6,895 4,562

Net actuarial (gain)/loss recognised (6,117) (4,345)

Total provision made during the year 778 217

Under the Gratuity Act No.12 of 1983, gratuity liability arises only upon an employee completing a continuous service of five years.

14.2 Principal actuarial assumptions used

Actuarial and Management Consultants (Pvt) Ltd., qualified actuaries carried out an actuarial valuation on the defined benefit plan-gratuity as at

31 December 2022. The assumptions used in determining the cost of retirement benefits are as follows.

Assumption 2022 2021

Discount interest rate* 19% per annum 11.3% per annum

Staff turnover rate 17% per annum 13% per annum

Salary increment rate 7.0% 7.0%

Retirement age 60 years 60 years

* In the absence of a deep market in long term bonds in Sri Lanka, a long term interest rate of 19% p.a ( 2021 - 11.3% p.a) has been used to

discount future liabilities considering anticipated long term rate of inflation.

14.3 Sensitivity analysis

The following table demonstrates the sensitivity to a reasonably possible change in the key assumptions used with all other variables held

constant in the retirement benefit obligation measurement.

As at 31 December 2022 2021

Increase / (decrease) Increase / (decrease)

of defined benefit of defined benefit

obligation obligation

Rs. ‘000 Rs. ‘000

Sensitivity analysis to discount rate

1% increase in discount rate (732) (1,215)

1% decrease in discount rate 779 1,332

Sensitivity analysis to salary escalation rate

1% increase in salary escalation rate 909 1,429

1% decrease in salary escalation rate (862) (1,322)

104 CA SRI LANKA | Integrated Annual Report 2022