Page 110 - 2596-CA SR Lanka- Annual Report 2022

P. 110

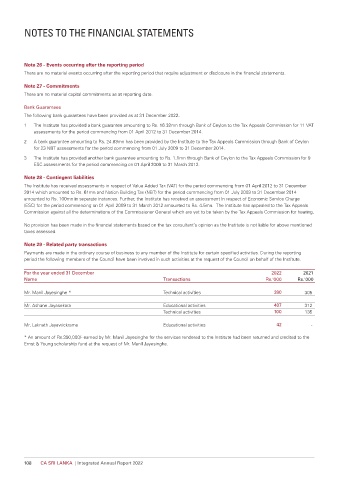

NOTES TO THE FINANCIAL STATEMENTS

Note 26 - Events occurring after the reporting period

There are no material events occurring after the reporting period that require adjustment or disclosure in the financial statements.

Note 27 - Commitments

There are no material capital commitments as at reporting date.

Bank Guarantees

The following bank guarantees have been provided as at 31 December 2022.

1 The Institute has provided a bank guarantee amounting to Rs. 16.32mn through Bank of Ceylon to the Tax Appeals Commission for 11 VAT

assessments for the period commencing from 01 April 2012 to 31 December 2014.

2 A bank guarantee amounting to Rs. 24.83mn has been provided by the Institute to the Tax Appeals Commission through Bank of Ceylon

for 23 NBT assessments for the period commencing from 01 July 2009 to 31 December 2014.

3 The Institute has provided another bank guarantee amounting to Rs. 1.1mn through Bank of Ceylon to the Tax Appeals Commission for 9

ESC assessments for the period commencing on 01 April 2009 to 31 March 2012.

Note 28 - Contingent liabilities

The Institute has received assessments in respect of Value Added Tax (VAT) for the period commencing from 01 April 2012 to 31 December

2014 which amounted to Rs. 61mn and Nation Building Tax (NBT) for the period commencing from 01 July 2009 to 31 December 2014

amounted to Rs. 100mn in separate instances. Further, the Institute has received an assessment in respect of Economic Service Charge

(ESC) for the period commencing on 01 April 2009 to 31 March 2012 amounted to Rs. 4.5mn. The Institute has appealed to the Tax Appeals

Commission against all the determinations of the Commissioner General which are yet to be taken by the Tax Appeals Commission for hearing.

No provision has been made in the financial statements based on the tax consultant’s opinion as the Institute is not liable for above mentioned

taxes assessed.

Note 29 - Related party transactions

Payments are made in the ordinary course of business to any member of the Institute for certain specified activities. During the reporting

period the following members of the Council have been involved in such activities at the request of the Council on behalf of the Institute.

For the year ended 31 December 2022 2021

Name Transactions Rs.'000 Rs.'000

Mr. Manil Jayesinghe * Technical activities 390 305

Mr. Ashane Jayasekara Educational activities 407 312

Technical activities 100 135

Mr. Laknath Jayawickrama Educational activities 42 -

* An amount of Rs.390,000/- earned by Mr. Manil Jayesinghe for the services rendered to the Institute had been returned and credited to the

Ernst & Young scholarship fund at the request of Mr. Manil Jayesinghe.

108 CA SRI LANKA | Integrated Annual Report 2022