Page 73 - CA Sri Lanka Integrated Annual Report 2023

P. 73

RISK MANAGEMENT

Managing risks has become imperative for organizations to ensure resilience and sustainable growth in today's dynamic landscape

marked by rapid technological advancements, evolving business paradigms, and stringent regulatory frameworks. Recognizing this

need, CA Sri Lanka has adopted a comprehensive risk management approach to proactively identify, assess and mitigate potential risks

that could impact its operations and stakeholders.

Risk management at CA Sri Lanka is a proactive endeavour aimed at anticipating and addressing emerging risks in a timely and efficient

manner. The Institute's risk management framework encompasses a systematic process of identifying risk events, evaluating their

potential implications and implementing robust controls and safeguards to mitigate these risks effectively.

Central to CA Sri Lanka's risk management approach is the regular review and updating of risk safeguards to align with the evolving

risk landscape and organizational priorities. This ensures that the Institute remains agile and responsive to changing risk dynamics,

enhancing its resilience and ability to navigate uncertainties effectively.

By embracing a comprehensive risk management approach, CA Sri Lanka reaffirms its commitment to fostering a culture of risk

awareness and resilience, underpinning its steadfast pursuit of excellence and sustainable growth in the face of evolving challenges.

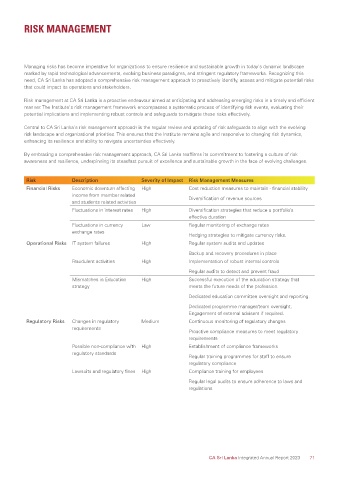

Risk Description Severity of Impact Risk Management Measures

Financial Risks Economic downturn affecting High Cost reduction measures to maintain - financial stability

income from member related Diversification of revenue sources

and students related activities

Fluctuations in interest rates High Diversification strategies that reduce a portfolio’s

effective duration

Fluctuations in currency Law Regular monitoring of exchange rates

exchange rates

Hedging strategies to mitigate currency risks.

Operational Risks IT system failures High Regular system audits and updates

Backup and recovery procedures in place

Fraudulent activities High Implementation of robust internal controls

Regular audits to detect and prevent fraud

Mismatches in Education High Successful execution of the education strategy that

strategy meets the future needs of the profession.

Dedicated education committee oversight and reporting.

Dedicated programme manager/team oversight.

Engagement of external advisers if required.

Regulatory Risks Changes in regulatory Medium Continuous monitoring of regulatory changes

requirements

Proactive compliance measures to meet regulatory

requirements

Possible non-compliance with High Establishment of compliance frameworks

regulatory standards

Regular training programmes for staff to ensure

regulatory compliance

Lawsuits and regulatory fines High Compliance training for employees

Regular legal audits to ensure adherence to laws and

regulations

CA Sri Lanka Integrated Annual Report 2023 71