Page 114 - CA Sri Lanka Integrated Annual Report 2023

P. 114

NOTES TO THE FINANCIAL STATEMENTS

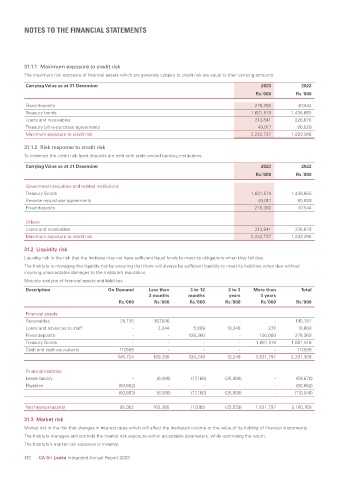

31.1.1 Maximum exposure to credit risk

The maximum risk exposure of financial assets which are generally subject to credit risk are equal to their carrying amounts.

Carrying Value as at 31 December 2023 2022

Rs.'000 Rs.'000

Fixed deposits 278,360 87,544

Treasury bonds 1,681,519 1,438,665

Loans and receivables 213,841 226,678

Treasury bill re-purchase agreements 49,017 80,029

Maximum exposure to credit risk 2,222,737 1,832,916

31.1.2 Risk response to credit risk

To minimise the credit risk fixed deposits are held with state owned banking institutions.

Carrying Value as at 31 December 2023 2022

Rs.'000 Rs.'000

Government securities and related institutions

Treasury Bonds 1,681,519 1,438,665

Reverse repurchase agreements 49,017 80,029

Fixed deposits 278,360 87,544

Others

Loans and receivables 213,841 226,678

Maximum exposure to credit risk 2,222,737 1,832,916

31.2 Liquidity risk

Liquidity risk is the risk that the Institute may not have sufficient liquid funds to meet its obligations when they fall due.

The Institute is managing the liquidity risk by ensuring that there will always be sufficient liquidity to meet its liabilities when due without

incurring unacceptable damages to the Institute’s reputation.

Maturity analysis of financial assets and liabilities

Description On Demand Less than 3 to 12 2 to 3 More than Total

3 months months years 3 years

Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000

Financial assets

Receivables 28,135 167,046 - - - 195,181

Loans and advances to staff - 2,244 5,889 10,249 278 18,660

Fixed deposits - - 128,360 - 150,000 278,360

Treasury Bonds - - - - 1,681,519 1,681,519

Cash and cash equivalents 117,589 - - - - 117,589

145,724 169,290 134,249 10,249 1,831,797 2,291,309

Financial liabilities

Lease liability - (6,910) (17,160) (35,808) - (59,878)

Payables (50,662) - - - - (50,662)

(50,662) (6,910) (17,160) (35,808) - (110,540)

Net financial assets 95,062 162,380 117,089 (25,559) 1,831,797 2,180,769

31.3 Market risk

Market risk is the risk that changes in interest rates which will affect the Institute’s income or the value of its holding of financial instruments.

The Institute manages and controls the market risk exposure within acceptable parameters, while optimising the return.

The Institute’s market risk exposure is minimal.

112 CA Sri Lanka Integrated Annual Report 2023