Page 103 - CA Sri Lanka Integrated Annual Report 2023

P. 103

4.1 Impairment of intangible assets

The Management has assessed the potential impairment loss of intangible assets as at 31 December 2023. Based on the assessment, no

impairment provision is required to be made in the financial statements as at the reporting date in respect of intangible assets.

4.2 Intangible assets pledged as security

There were no items of intangible assets pledged as securities for liabilities as at the reporting date.

4.3 Title restriction on intangible assets

There are no restrictions that existed on the title of the intangible assets of the Institute as at the reporting date.

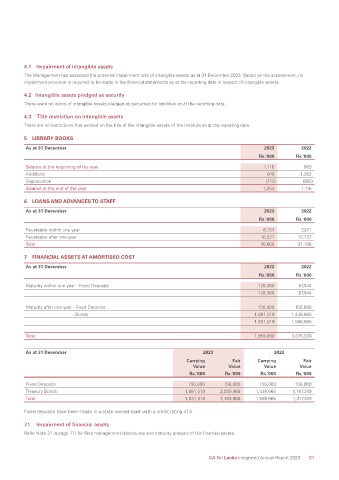

5 LIBRARY BOOKS

As at 31 December 2023 2022

Rs.'000 Rs.'000

Balance at the beginning of the year 1,116 669

Additions 910 1,352

Depreciation (772) (905)

Balance at the end of the year 1,254 1,116

6 LOANS AND ADVANCES TO STAFF

As at 31 December 2023 2022

Rs.'000 Rs.'000

Receivable within one year 8,133 7,371

Receivable after one year 10,527 13,737

Total 18,660 21,108

7 FINANCIAL ASSETS AT AMORTISED COST

As at 31 December 2023 2022

Rs.'000 Rs.'000

Maturity within one year - Fixed Deposits 128,360 87,544

128,360 87,544

Maturity after one year - Fixed Deposits 150,000 150,000

- Bonds 1,681,519 1,438,665

1,831,519 1,588,665

Total 1,959,880 1,676,209

As at 31 December 2023 2022

Carrying Fair Carrying Fair

Value Value Value Value

Rs.'000 Rs.'000 Rs.'000 Rs.'000

Fixed Deposits 150,000 150,000 150,000 150,000

Treasury Bonds 1,681,519 2,039,968 1,438,665 1,167,319

Total 1,831,519 2,189,968 1,588,665 1,317,319

Fixed deposits have been made in a state owned bank with a credit rating of A

7.1 Impairment of financial assets

Refer Note 31 in page 111 for Risk management disclosures and maturity analysis of the financial assets.

CA Sri Lanka Integrated Annual Report 2023 101