The Institute of Chartered Accountants of Sri Lanka (CA Sri Lanka) recently launched two new publications on taxation in its continuing efforts to keep both tax professionals and general public updated on the subject.

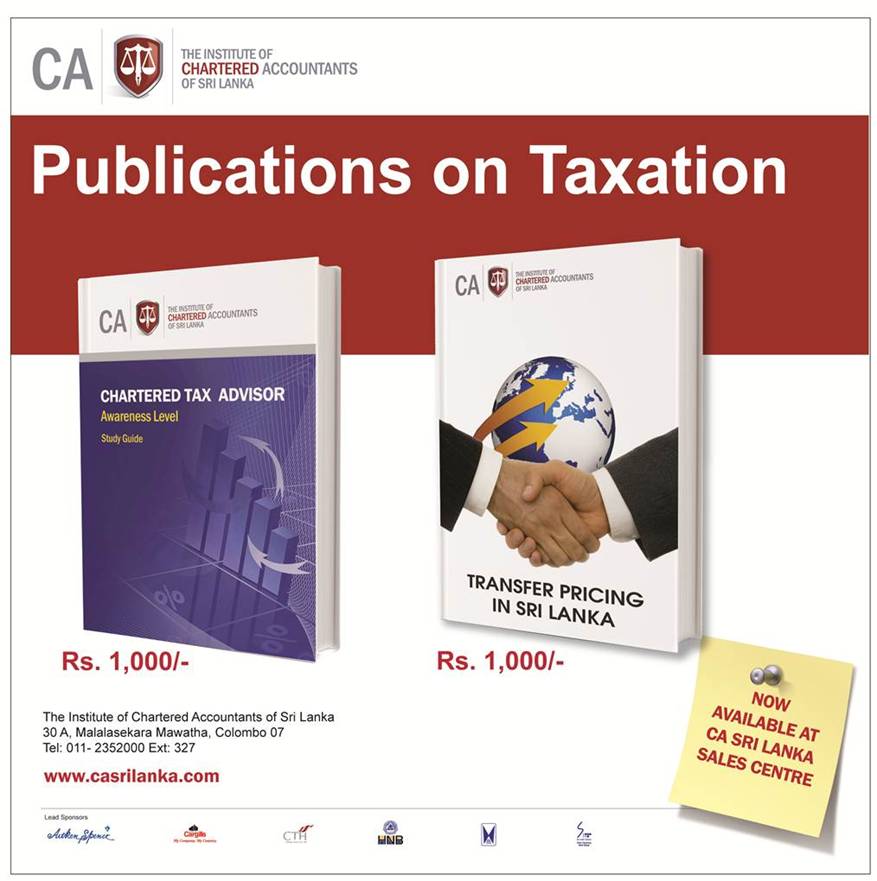

The two publications titled ‘Transfer Pricing in Sri Lanka’ and the ‘Chartered Tax Advisor - Awareness Level Study Guide’ are priced at Rs. 1000 each and is available at the CA Sri Lanka Sales Centre in Colombo 7.

The objective of the Transfer Pricing publication is to focus on how the applications of these provisions work in practice to enable the associated undertakings to put in place the appropriate steps to comply with the transfer pricing provisions.

Transfer pricing is the application of the arm’s length principle to ensure that transfer prices between associated undertakings reflect the prices used in identical or similar uncontrolled transactions. The application of the arm’s length principle has wide international acceptance in determining taxable profits of both domestic associated undertakings as well as multinational associated undertakings.

The second publication which is the Study Guide for the Awareness Level of the Chartered Tax Advisor course covers the rules on Income Tax and Economic Service Charge for the year of assessment 2011/2012 and that of Value Added Tax and Nation Building Tax for the year 2011.

Late last year, the Institute launched a comprehensive professional taxation course called the Chartered Tax Advisor to enhance the quality of tax consultancy services together with the tax compliance as a whole for professionals and members of the public interested in the subject. This newly published booklet has therefore been developed as the study guide for the Awareness Level of this course for the benefit of the students who are sitting for this particular course.