ශ්රී ලංකා වරලත් ගණකාධිකරණ ආයතනයේ විෂය මාලාව වෙනස් වන ලෝකයේ ව්යාපාරික ක්රියාකාරකම්හි ගෝලීයකරණයට සහ වෘත්තීමය අධ්යාපනයට ප්රතිචාර දැක්වීමක් වශයෙන් නිර්මාණය කර ඇත. මෙම අරමුණ සාක්ෂාත් කර ගැනීම සඳහා සෑම වසර 5කට වරක් ම මෙම විෂය මාලාවන් යාවත් කාලීන කරනු ලබයි.

........... ඉදිරියට මෙම විෂය මාලා සංශෝධනය ක්රියාත්මක වේ.

The next curriculum revision will be effective from the ........... examinations onwards.

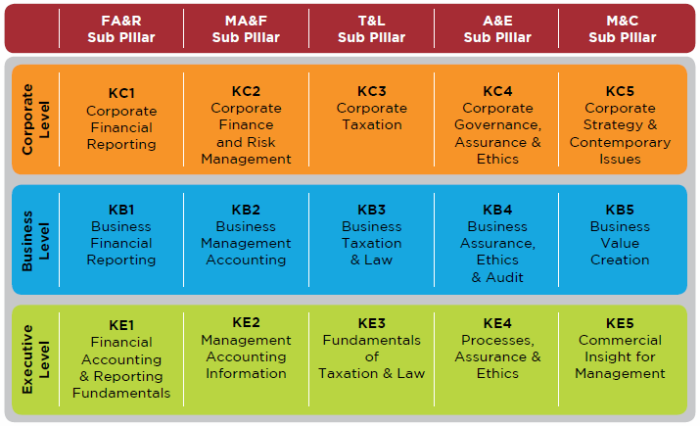

නව විෂය මාලාව මූලික උපකාරක (ආධාරක) තුනකින් සමන්විත වේ. දැනුම, කුසලතාවය, පෞද්ගලික, ආදී වශයෙන් පහත පරිදි විෂය මාලා රාමුව සැකසී ඇත.

මෙම ව්යුහය මගින් සිසුන්ට ක්රමක් ක්රමයෙන් ඉහළ තලයන්හි ජයග්රහණයන් ලබා ගැනීම සඳහා මෙන්ම තම කුසලතා වර්ධනය කර ගැනිමත් රැකියාවේ අභිවෘද්ධිය ඇති කර ගැනීමට අවශ්ය පරිසරය නිර්මාණය කරයි. මෙම ආකෘතිය ඔස්සේ පරිපූර්ණ වරලත් ගණකාධිකාරිවරයෙකු වීමට පෙර තමන්ගේ රුචිකත්වය මත ප්රධාන අමතර විකල්ප දෙකක් ලබාදෙයි.

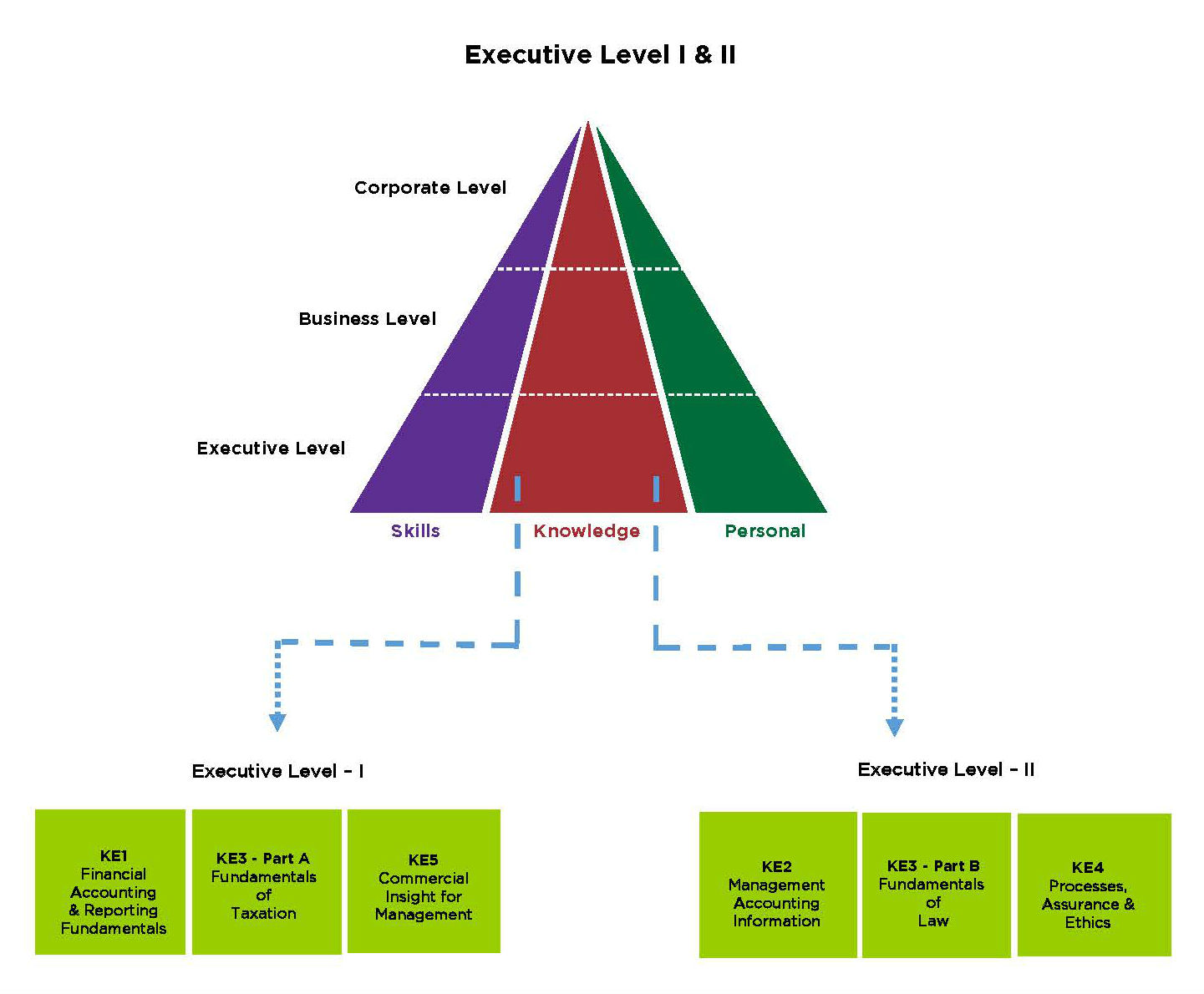

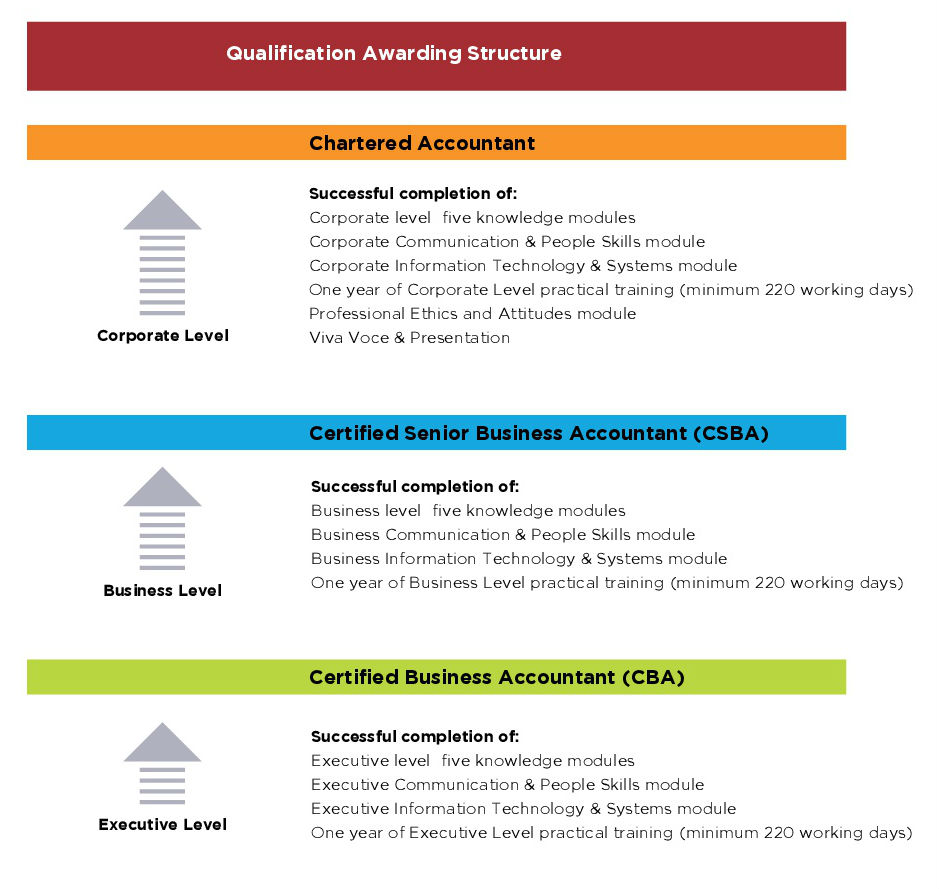

එක් එක් ස්ථර වලදී ලබා ගන්නා සුදුසුකම් සහ ආධාරක ස්ථර අතර අන්තර් සම්බන්ධතාවය පහත දැක්වේ.

සෑම ආධාරකයක් ම අදියර තුනකින් සමන්විත වේ. දැනුම් ආධාරකය අනු ආධාරක 5කින් සමන්විත වන අතර එය ඉහත දැක්වූ ස්ථර තුනෙහි සෑම ස්ථරයකදී ම විහිදී ඇත. ඒ අකාරයටම දැනුම් ආධාරකය උප ආධාරක දෙකකින් යුක්ත වන අතර එමගින් විෂයන් හයකට මාර්ගෝපදේශනය ලබාදෙයි. පෞද්ගලික උපකාරකය පුහුණුවීම් සහ සංවර්ධනය මූලික කරගෙන නිර්මාණය වී ඇති අතර එහි සෑම ස්ථරයක් ම එයට ආවේණික විශේෂිත අවශ්යතා පවතී.

වරලත් ගණාධිකාරී සුදුසුකම් අතරින් මූලික ආධාරකය (හරය) වන්නේ, දැනුම් ආධාරකයයි. උප ආධාරක 5ක් ඔස්සේ, පාඨමාලා ඒකක 15කින් සැකසී ඇති අතර එමගින් වරලත් ගණාකාධිකාරිවරුන්ට අචාරධර්මානුකූල පදනමක් යටතේ ඔවුන්ගේ ප්රධාන භූමිකාවන් මෙහෙයවීමට අවශ්ය වන තාක්ෂණික දැනුම ලබා දීමට සකස් කර ඇත. මෙමගින් මූල්ය ක්ෂේත්රයේ නායකත්වය සහ අගය නිර්මාණය කිරිම් ඔස්සේ ව්යාපාර ලෝකයෙහි දිශානතීන් පුළුල් කිරිමට ඉඩ සලසා දෙයි.

උප අධාරක:

Sub pillar 1: Financial Accounting and Reporting (FA&R)

Sub pillar 2: Management Accounting and Finance (MA&F)

Sub pillar 3: Taxation and Law (T&L)

Sub pillar 4: Assurance and Ethics (A&E)

Sub pillar 5: Management and Contemporary Issues (M&C)

සෑම පාඨමාලා ඒකකයක් සඳහා ඇති අකුරු 3කින් සමන්විත කේතය මගින් ආධාරක නිරූපණය වේ. ඒකක, අනු ආධාරක පිළිවෙලින්; නිදසුන: KB 3 - දැනුම් ආධාරකය (k) සඳහා ද, ව්යාපාරික මට්ටමේදී ද අනෙකුත් උප ආධාරක (3)මගින් ද සංකේතවත් වේ.

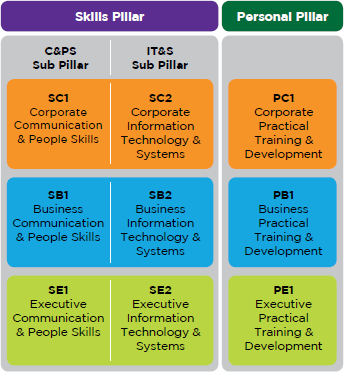

Skills Pillar

The Skills Pillar has been developed from the ground up to address the need for soft skills of CAs. Two modules structured under two sub pillars will develop the communication skills and IT literacy of the students.

The two sub pillars are:

Sub pillar 1: Communication and People Skills (C&PS)

Sub pillar 2: Information Technology and Systems (IT&S)

Personal Pillar

The Personal Pillar entails practical training within a period of three years in an approved training organization. Training requirements have been developed in line with the research carried out and based on IFAC IESs for developing professional competencies.

During this training period, students are expected to acquire sufficient practical work experience in technical and functional skills, intellectual skills, personal skills, interpersonal and communication skills, organizational and business management skills and professional values, ethics and attitudes.

No. You can apply Business Level subjects only if you have completed Executive communication skills (SE 1) or Business English II in previous syllabus.

The Practical Training scheme was revamped along with the new curriculum and the new training requirements have been developed in line with the International Accounting Education Standards for developing professional competences for aspiring professional accountants and based on stakeholder expectations.

The total training requirement has been designed to be completed within a 3-year period while completing a minimum of 660 working days. There will not be any change in the total training period but the name of each level will be changed as follows:

The total period of approved practical training is divided into two phases:

- Executive Level

- Business & Corporate Level

- Business Level

- Corporate level

The training should be registered under a Training Agreement in order to be recognized as valid practical training. The Executive Level Training Agreement shall be separated from the Corporate Level Training Agreement.

| 2010 Training Scheme | 2015 Training Scheme |

|---|---|

| Students who completed Certificate level training |

Exempted from: Executive level training |

| Students who completed STR Level I training (Diploma level) | Exempted from: Business level training |

| Students who completed STR Level II training | Exempted from: Corporate level training |

Existing training agreements as at 31.12.2014

| Certificate level |

: | These students can continue training with the existing scheme |

| Strategic level |

: | These students can continue training with the existing scheme and in addition should complete the new Ethics module |

- Introducing the online professional ethics module

- Combination of input and output based approach

- Six month review by a supervising member

- Recognition of work performed at weekends

- The supervising member should sign off Regulations 27 & 29 at executive level training prior to commencement of the corporate & business level.

A web based module on Professional Ethics and Attitudes will be introduced prior to the viva-voce. This is similar to the [slimier?] module Work Based Learning Questions in the previous curriculum. This will replace the online Professional Ethics modules.

Accordingly, by the end of the training period a trainee should be:

- Familiar with the Professional Code of Ethics of the institutes.

- Able to identify and analyze the ethical issues likely to be encountered in their work environment.

- Understand the procedures for resolving ethical issues.

Students who apply for the viva voce on or after 31.03.2015 should complete the new ethics module

Instead of the traditional method of measuring achievement only through an input based approach with a specified number of working days as a minimum, a combination of input based and output based approaches will be used in the revised training scheme.

Under this approach, trainees are required to record their achievements in acquiring professional skills and competencies in every quarter while supervising members are required to evaluate and sign them off every six months.

The following areas should be developed by students seeking to become professional accountants.

- Technical and functional skills

- Intellectual skills

- Personal skills

- Interpersonal and communication skills

- Organizational and business management skills

- Professional values, ethics and attitudes

Yes. Work carried out during weekends will be recognized up to a maximum of 10 days per annum

The six-month penalty extension owing to unauthorized interruptions will be changed in the new syllabus. The penalty period will be reduced as follows:

| Period of interruption | Extension period |

|---|---|

| Less than 1 month | Warning (no extension) |

| I month < 6 months | 1 month |

| 6 months < 1 year | 2 months |

| More than 1 year | 6 months |

- Students who have completed practical training two years ago or do not have a proper topic for the viva from the training period are allowed to prepare a presentation from their current experience.

- Link the viva with the final assessment of the soft skill development process

- Set guidelines for preparation of the viva presentation

- Marking Scheme:

Students should be assessed according to a marking scheme and those who are unable to achieve the required marks should present it again to the same panel or another panel as appropriate.

Proposed criteria for marking

- Preparation of the presentation; development of the case rationally, flow, appropriateness of slides, content, free of errors

- Presentation skills (voice, body language, analytical skills, eye contact, etc.)

- Technical knowledge of the topic

The following are the training concessions for SII examinations – June/December 2014 considering the change in the syllabus with effect from 2015.

Students who complete the following training requirements before the closing date for S II examination applications, are permitted to sit for the S II examination in June and December 2014, subject to the satisfaction of all other specified requirements:

- Successful completion of Certificate level training

- Having applied for Intermediate /CAB certificate

- Register for the Strategic level training agreement before the closing date of the SII examination

නිතර අසන පොදු ප්රශ්න

ඔව්. සියලූම සිසුන්ට මෙම වෙනස්කම් අදාළ වේ.

නැත. ඉහත පාඨමාලා අනිවාර්යයෙන්ම සලකා බැලේ. සාමාජිකත්වය ලබා ගැනීම සඳහා ඔබට පහසු වන විධිවිධාන සලසා ඇත.

2015 විෂය මාලාව පරිහරණය කරන්න

| Executive Level I & II |

– | Sinhala Medium / Tamil Medium / English Medium |

| Business Level | – | English Medium |

| Corporate Level | – | English Medium |

එවැනි අවශ්යතාවයක් නොමැත.

| අදියර | ඇගයුම් ස්වභාවය |

|---|---|

| Executive Level | |

| සංවෘත ග්රන්ථ විභාග | |

| Business Level | |

| KB1/3 |

සංවෘත ග්රන්ථ විභාග |

| KB2/4/5 | සංවෘත ග්රන්ථ විභාග |

| Corporate Level | |

| KC1/ KC3/ KC4/ KC5 | සංවෘත ග්රන්ථ විභාග |

| KC2 | සංවෘත ග්රන්ථ විභාග |

Recommended Open Book Referential (for June 2018 Business & Corporate Level Exams)

KB 1 & KC 1

- Sri Lanka Accounting Standards 2017 or 2018 (2018 version will be available by end February 2018)

- Open Book Referential - Student Version (Statement of Alternative Treatment, Sri Lanka

- Statement of Recommended practice, IFRICS and SICs)

- CA Sri Lanka approved IFRIC 22: Foreign Currency Transactions and Advance Consideration

- CA Sri Lanka approved IFRIC 23: Uncertainty over Income Taxes

- Code of Best Practice on Corporate Governance 2017

- Sri Lanka Accounting Standard for SMEs 2015

- Publication on SLFRS 9, SLFRS 15 and SLFRS 16

- Sri Lanka Accounting Standard for Smaller Entities - 2015

KB 3

- Business Taxation

- Value Added Tax Act No. 14 of 2002 and the subsequent amendments

- Nation Building Tax Act No. 09 of 2009 and the subsequent amendments

- Business Law

- Company Act No. 07 of 2007

KC 4

- Sri Lanka Auditing Standards & Sri Lanka Standard on Quality Control (2017 Edition - Volume 01) (will be available by mid February 2018)

- Sri Lanka Standards on other Assurance Engagements and Related Services (2017 Edition - Volume 02) (will be available by mid February 2018)

- Sri Lanka Framework for Audit Quality and Sri Lanka Framework for Assurance Engagements (2017 Edition - Volume 03) (will be available by mid February 2018)

- Code of Ethics 2016

- Sri Lanka Accounting Standards 2017 or 2018 (2018 version will be available by end February 2018)

- Open Book Referential - Student Version (Statement of Alternative Treatment, Sri Lanka Statement of Recommended practice, IFRICS and SICs)

- CA Sri Lanka approved IFRIC 22: Foreign Currency Transactions and Advance Consideration

- CA Sri Lanka approved IFRIC 23: Uncertainty over Income Taxes

- Code of Best Practice on Corporate Governance 2017

- Publication on SLFRS 9, SLFRS 15 and SLFRS 16

- Sri Lanka Accounting Standard for Smaller Entities - 2015

| Module Code | Module Name | Study Materials & Recommended Reading Materials |

|---|---|---|

| Financial Accounting & Reporting pillar | ||

| KE1 | Financial Accounting & Reporting Fundamentals |

|

| KB1 | Business Financial Reporting |

|

| KC1 | Corporate Financial Reporting |

|

| Management Accounting & Finance Pillar | ||

| KE2 | Management Accounting Information |

|

| KB2 | Business Management Accounting |

|

| KC2 | Corporate Financial and Risk Management |

|

| Tax & Law Pillar | ||

| KE3 | Fundamentals of Taxation & Law | Fundamentals of Taxation

|

| KB3 | Business Taxation & Law | Business Taxation

|

| KC3 | Corporate Taxation |

|

| Assurance and Ethics Pillar | ||

| KE4 | Controls, Assurance & Ethics |

|

| KB4 | Business Assurance, Ethics & Audit |

|

| KC4 | Corporate Governance, Assurance & Ethics |

|

| Management & Contemporary Pillar | ||

| KE5 | Commercial Insight for Management |

|

| KB5 | Business Value Creation |

|

| KC5 | Corporate strategy & Contemporary issues |

|

2015 විෂය මාලාවේ 13 , 14 පිටු පරීක්ෂා කරන්න.

www.casrilanka.com –> ශිෂ්ය ශිෂ්යාවන් –> 2015 විෂය මාලාව

2015 විෂය මාලාවේ 22 පිටුව පරීක්ෂා කරන්න.

www.casrilanka.com –> ශිෂ්ය ශිෂ්යාවන් –> 2015 විෂය මාලාව

කරුණාකර අධ්යාපනික අංශය හා සම්බන්ධ වන්න.

| විමසීම්: | ශිෂ්ය සම්බන්ධතා මධ්යස්ථානය | : | +94 11 2352099 |

| කාර්යාලය | : | +94 11 2352029 | |

| ෆැක්ස් | : | +94 11 2352060 | |

| ඊ-මේල් | : | මෙම ඊ-තැපැල් ලිපිනය spambots ගෙන් සුරක්ෂිත කොට ඇත. මෙය බැලීම සදහා ඔබට JavaScript සක්රීය කිරීම අවශ්යවේ | |

| වෙබ් අඩවිය | : | http://www.casrilanka.com |